Liquid net worth is the total value of a person’s easily accessible assets, including cash and cash equivalents. It excludes illiquid assets like real estate or collectibles. Understanding this metric helps assess financial health.

Knowing your liquid net worth is crucial for financial planning. It shows how quickly you can access funds in emergencies. A higher liquid net worth indicates better financial flexibility, which empowers better decision-making.

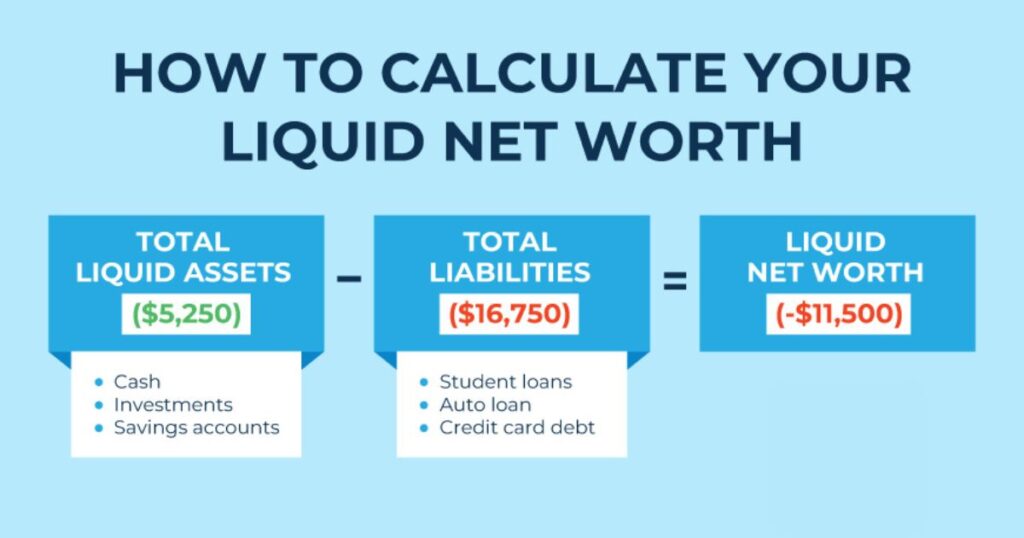

To calculate liquid net worth, add your cash, savings, and investments. Subtract any liabilities, like debts or loans. Regularly tracking this figure helps in managing expenses. It also aids in setting savings goals for the future.

what is my liquid net worth

Your liquid net worth is a snapshot of your financial health. It shows how much cash and easily accessible assets you have. To find it, list all your liquid assets. This includes cash, savings, and stocks.

Next, subtract your short-term debts. These can be credit card balances or loans. The result is your liquid net worth. It helps you understand your financial flexibility.

A higher liquid net worth means more financial security. Regularly checking this figure keeps you informed. It guides your budgeting and investment choices.

what is a liquid net worth

Liquid net worth is the total of your easily accessible assets. This includes cash, savings, and liquid investments. It excludes illiquid assets like property or retirement accounts. Essentially, it shows your financial flexibility at a glance.

Key Points

- Net worth is the value of your assets minus your liabilities, while liquid net worth focuses on easily accessible assets.

- Liquid net worth includes cash, checking and savings accounts, stocks, bonds, and other assets that can be quickly converted to cash.

- Non-liquid assets like real estate and retirement accounts are not included in liquid net worth calculations.

- Liquid net worth is important for financial stability and emergency preparedness.

- Strategies for improving liquid net worth include building an emergency fund, reducing expenses, paying off high-interest debt, and increasing investments.

what is liquid net worth mean

Liquid net worth refers to the total value of your liquid assets. These are assets that can be quickly converted to cash. Examples include cash in hand, savings accounts, and stocks. It excludes illiquid assets like real estate or retirement funds.

People Also Read This Blog: trump oscars

Understanding liquid net worth is crucial for financial planning. It shows how much money you can access easily. A higher liquid net worth means more financial flexibility. This figure helps in budgeting and managing expenses.

Regularly assessing it can guide your investment choices. It reflects your immediate financial health. Monitoring changes over time is essential. It helps you make informed financial decisions.

what is my liquid net worth calculator

A liquid net worth calculator helps you assess your finances. It adds up your easily accessible assets like cash and stocks. It subtracts your short-term debts. This gives you a clear picture of your liquidity.

Using the calculator is simple and quick. It guides your budgeting and financial planning. Regular checks can show your progress over time. This tool empowers you to make informed decisions.

Net Worth vs Liquid Net Worth

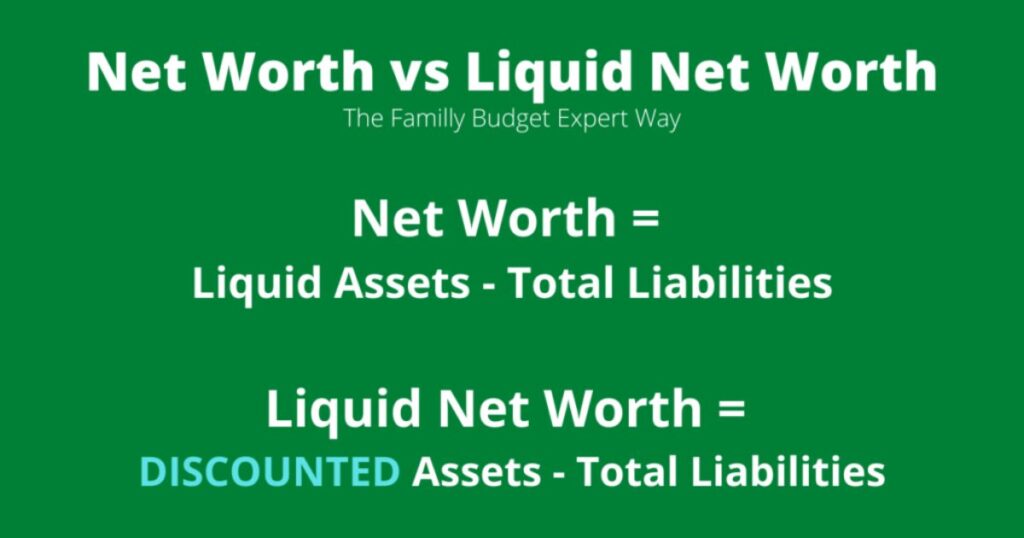

As briefly mentioned above, your total net worth includes all of your assets (what you own) and liabilities (what you owe). When you determine your net worth, you add up all your assets, including non-liquid assets, such as your house, car, and retirement accounts, and then subtract all of your liabilities. The resulting number is your total net worth.

- Your liquid net worth is the amount of money you have in cash or cash equivalents (assets that can be easily converted into cash) after you’ve deducted all of your liabilities.

- It’s very similar to net worth, except that it doesn’t account for non-liquid assets such as real estate or retirement accounts.

Guide to Liquid Net Worth

A guide to liquid net worth helps you understand your financial situation. It focuses on easily accessible assets and short-term debts. Knowing this figure aids in better financial planning. Regular reviews can enhance your financial confidence.

- Identify your liquid assets like cash and stocks.

- Subtract any short-term liabilities or debts.

- Use this knowledge to make informed financial decisions.

What Is Liquid Net Worth?

Liquid net worth is the total value of your easily accessible assets. It includes cash, savings, and liquid investments.

This figure helps you understand your financial flexibility. It excludes illiquid assets like real estate. Knowing your liquid net worth is key for effective budgeting.

- Calculate by adding cash and liquid investments.

- Subtract any short-term debts from the total.

- Use it to assess your financial health and readiness.

What Counts for Liquid Net Worth Calculations?

Liquid net worth calculations include various accessible assets. Cash on hand is the most straightforward example. Savings accounts also count as liquid assets. Stocks and bonds are included too.

These can be sold quickly for cash. Money market accounts add to your total as well. On the other hand, retirement accounts are usually excluded. This is because they may have penalties for early withdrawal.

Short-term investments are also counted. Debts like credit cards or personal loans are subtracted. Understanding these components helps clarify your financial position.

Net Worth vs Liquid Net Worth

Net worth represents the total value of all your assets. This includes both liquid and illiquid assets like property. Liquid net worth focuses only on easily accessible assets.

It gives insight into your financial flexibility. Understanding both helps in effective financial planning.

- Net worth includes everything you own and owe.

- Liquid net worth highlights cash and liquid investments.

- Both metrics are important for financial health assessment.

Why Liquid Net Worth Matters

Liquid net worth matters because it shows your financial flexibility. It helps you understand how quickly you can access cash.

This figure is crucial for emergency planning and investments. Knowing your liquid net worth aids in better budgeting decisions. It reflects your immediate financial health.

- It highlights your ability to cover short-term expenses.

- It guides investment opportunities and risk management.

- Regular assessments help track financial progress and goals.

Get up to $300 when you bank with SoFi

With SoFi, you can earn up to $300 just for banking with them. Opening an account is simple and quick. SoFi offers attractive interest rates on your deposits. You can manage your finances easily through their app.

They also provide financial advice and tools. Enjoy no monthly fees and no minimum balance. This offer helps you grow your savings faster. Start banking with SoFi and take advantage of this bonus today.

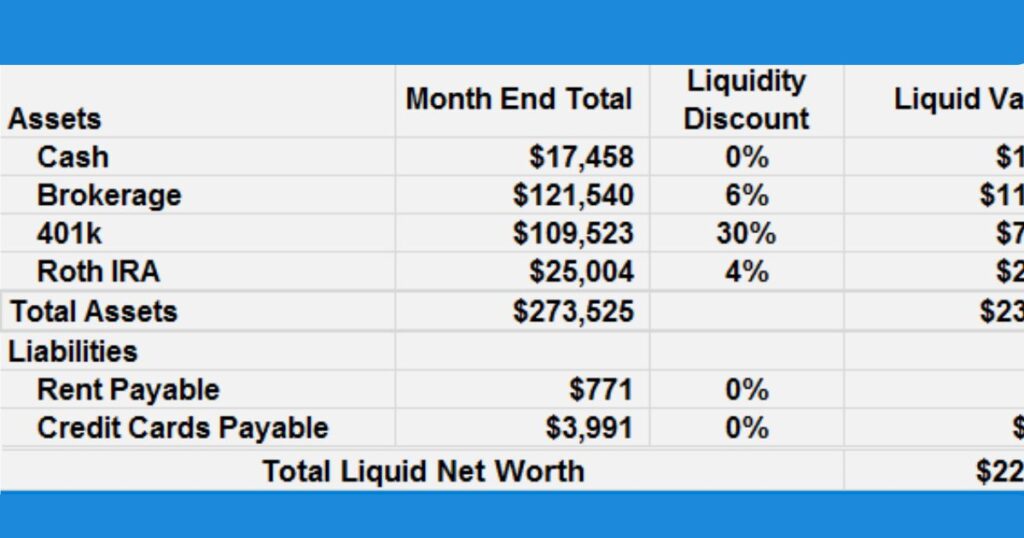

Calculating Your Liquid Net Worth

Calculating your liquid net worth is straightforward. Start by listing all liquid assets, like cash and savings. Include stocks and bonds that can be quickly sold. Next, add up these assets for a total.

Don’t miss to read out this blog: Don King Net Worth

Identify any short-term debts you owe. This includes credit card balances and personal loans. Subtract the debts from your total assets. The result gives you your liquid net worth, reflecting your financial flexibility.

Liquid Net Worth Formula

The liquid net worth formula is simple to understand. Start with your total liquid assets. This includes cash, savings, and easily sellable investments. Next, identify your short-term liabilities.

These are debts like credit card balances and loans. The formula is: Liquid Net Worth = Total Liquid Assets – Short-Term Liabilities. This calculation reveals your financial flexibility. Knowing this number helps you plan for the future effectively.

Net Worth vs Liquid Net Worth

As briefly mentioned above, your total net worth includes all of your assets (what you own) and liabilities (what you owe). When you determine your net worth, you add up all your assets, including non-liquid assets, such as your house, car, and retirement accounts, and then subtract all of your liabilities. The resulting number is your total net worth.

- Your liquid net worth is the amount of money you have in cash or cash equivalents (assets that can be easily converted into cash) after you’ve deducted all of your liabilities.

- It’s very similar to net worth, except that it doesn’t account for non-liquid assets such as real estate or retirement accounts.

4 Tips for Improving Liquid Net Worth

Improving your liquid net worth is essential for financial health. Start by building an emergency fund with cash savings. Reduce high-interest debt to free up more money. Consider investing in liquid assets like stocks or bonds.

Regularly review your budget to cut unnecessary expenses. Automate savings to ensure consistent contributions. Track your progress monthly to stay motivated. Small changes can lead to significant improvements over time.

1. Building an Emergency Fund

Building an emergency fund is crucial for financial security. Start by setting a savings goal, typically three to six months of expenses. Contribute regularly to reach your target. This fund provides peace of mind during unexpected events.

- Aim for quick access to your savings.

- Choose a high-yield savings account.

- Automate transfers to make saving easier.

2. Reducing Expenses

Reducing expenses is key to improving your financial health. Start by tracking your spending to identify areas to cut. Small changes can lead to significant savings over time. Focus on needs versus wants to prioritize your budget.

- Cancel unused subscriptions and memberships.

- Cook meals at home instead of dining out.

- Shop with a list to avoid impulse purchases.

3. Lowering High-Interest Debt

Lowering high-interest debt is vital for financial freedom. Start by listing all your debts from highest to lowest interest rates. Focus on paying off the highest rates first to save money. Consider consolidating debts for lower interest options.

- Make extra payments whenever possible.

- Negotiate lower rates with your creditors.

- Avoid accumulating new debt during this process.

4. Increasing Investments

Increasing investments is essential for building wealth. Start by setting clear financial goals for your investments. Diversify your portfolio to reduce risks and enhance returns. Regularly contribute to your investment accounts for steady growth.

- Research investment options that suit your risk tolerance.

- Consider automated investing platforms for convenience.

- Monitor and adjust your portfolio periodically for optimal performance.

Net Worth vs Liquid Net Worth

As briefly mentioned above, your total net worth includes all of your assets (what you own) and liabilities (what you owe). When you determine your net worth, you add up all your assets, including non-liquid assets, such as your house, car, and retirement accounts, and then subtract all of your liabilities. The resulting number is your total net worth.

- Your liquid net worth is the amount of money you have in cash or cash equivalents (assets that can be easily converted into cash) after you’ve deducted all of your liabilities.

- It’s very similar to net worth, except that it doesn’t account for non-liquid assets such as real estate or retirement accounts.

The Takeaway

The takeaway is simple, financial health matters. Start with budgeting and tracking your expenses. Prioritize saving and investing for the future. Small, consistent actions lead to significant improvements over time.

Conclusion

Liquid net worth is a key indicator of financial health. It reveals how quickly you can access your assets. Understanding this figure enables better budgeting and saving strategies. Regularly assessing your liquid net worth helps you prepare for emergencies.

It also guides your investment decisions. By focusing on improving this metric, you can enhance your financial security. Knowing your liquid net worth empowers you to achieve your financial goals more effectively.

FAQ’s

Does a 401(k) count as liquid net worth?

No, a 401(k) does not count as liquid net worth. It’s considered an illiquid asset because it can’t be easily accessed without penalties.

How do you calculate liquid net worth?

To calculate liquid net worth, add your cash, savings, and liquid investments. Then, subtract any debts or liabilities you owe.

What is the average liquid net worth by age?

The average liquid net worth varies by age, generally increasing over time. Younger individuals may have lower liquid assets, while those nearing retirement have higher amounts.

Does a 401k count as liquid net worth?

A 401(k) does not count as liquid net worth. It’s an illiquid asset because it isn’t easily accessible without penalties or restrictions.

What is liquid net worth Schwab?

Liquid net worth at Schwab refers to the easily accessible cash and investments in your account. It excludes less liquid assets like real estate or retirement accounts.

Angleena is an SEO expert, content writer, and guest posting specialist with 3+ years of experience. She excels in SEO, link building, and digital marketing while ensuring unique, high-quality content for clients.