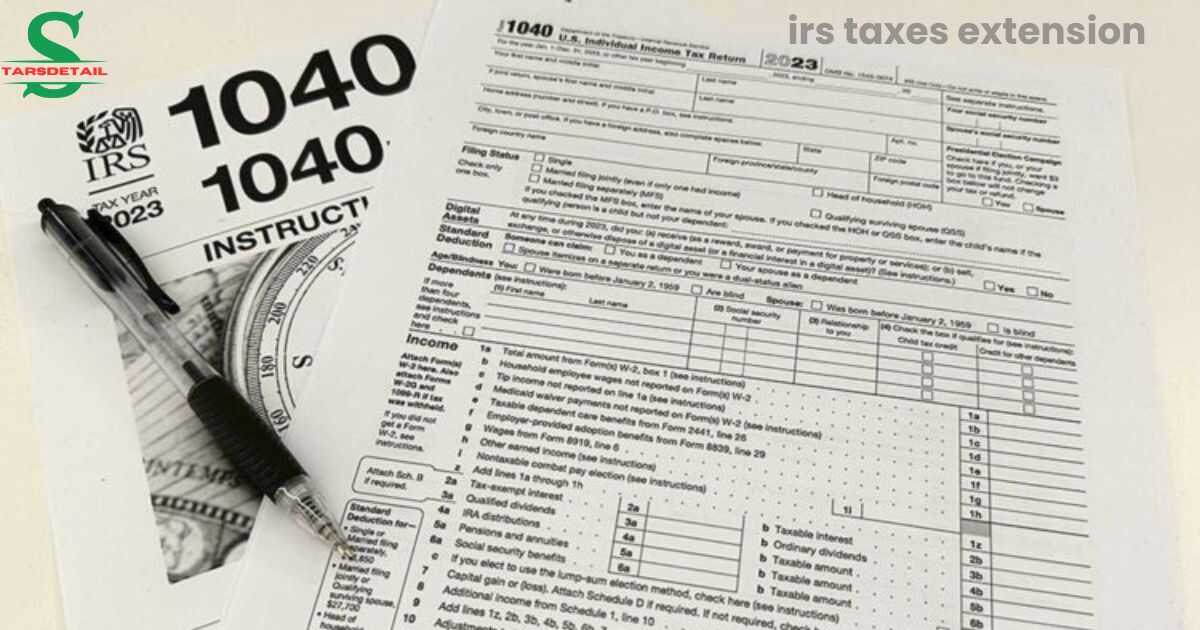

An IRS tax extension allows taxpayers extra time to file their federal tax returns. It is not an extension for payment, it is just for filing the paperwork. This means you can submit your return later than the usual deadline. Taxes owed must still be paid by the original deadline.

Feeling overwhelmed by tax season? You’re not alone. Many people choose to file for an extension to relieve stress. It gives you more time to gather documents and ensure accurate filing.

You can file Form 4868 electronically or by mail to apply for an extension. This grants you six months to file your return. An extension does not delay your tax payment. Always estimate and pay any tax owed to avoid penalties.

IRS extension Form

The IRS extension form, Form 4868, allows taxpayers to request an extra six months to file their tax returns. You can submit this form online or by mail.

Filing it is simple and quick, providing some relief during tax season. Remember, this extension does not delay tax payments due. You still need to estimate and pay any owed taxes by the original deadline.

Filing the form on time is crucial to avoid penalties. Keep a copy for your records. This extension is a helpful option for many taxpayers. Use it wisely to ensure accurate filings.

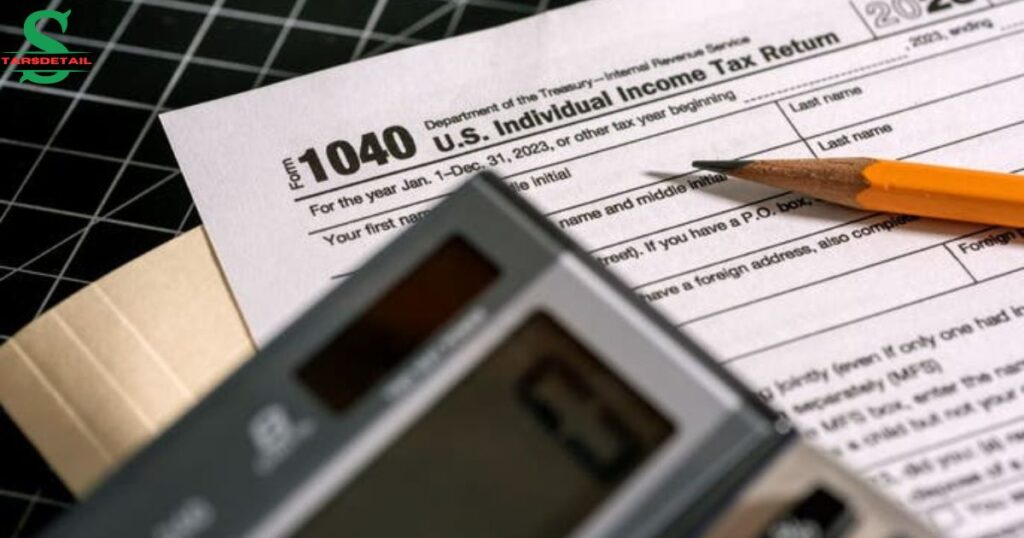

TurboTax file extension

TurboTax offers an easy way to file for a tax extension. Users can complete Form 4868 directly within the software. This process is quick and user-friendly. It gives you an extra six months to file your return.

Don’t miss to read out this blog: massachusetts plane crash

That taxes owed must still be paid by the original deadline. TurboTax will help you estimate your payment. Filing for an extension is a great way to reduce stress. Enjoy more time to gather your tax documents accurately.

Can I file another tax extension after October 15

No, you cannot file another tax extension after October 15. The IRS only allows one extension per tax year. If you miss this deadline, you must file your tax return as soon as possible. Late submissions may result in penalties and interest.

It’s important to prepare your return quickly to minimize risks. If you have special circumstances, consider contacting the IRS. Always stay updated on tax deadlines. Planning can ease future filing stress.

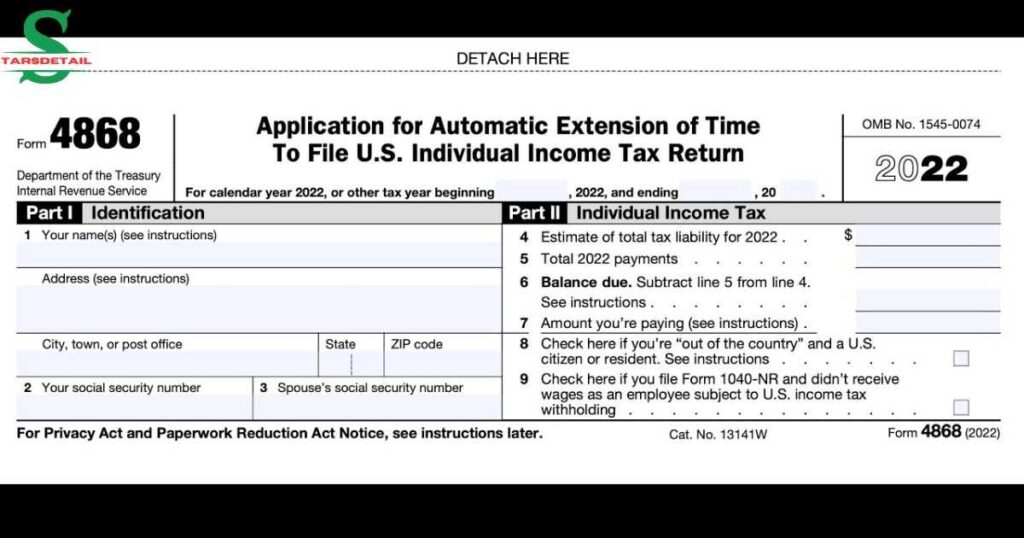

IRS Form 4868 online

IRS Form 4868 can be filed online for a tax extension. This form grants you an additional six months to submit your return. You can complete it through the IRS website or tax software. Filing online is quick and convenient.

Make sure to estimate any taxes owed beforehand. This helps you avoid penalties later on. Keep a confirmation of your submission for your records. It’s a simple way to manage your tax responsibilities.

Printable IRS Form 4868

You can get a printable version of IRS Form 4868 online. This form allows you to request a tax filing extension. Simply download it from the IRS website. After filling it out, you can mail it to the IRS.

Be sure to send it before the tax deadline. This ensures you get that six-month extension. Remember to estimate any taxes owed and send payment if needed. Keeping a copy of your form is always a good idea.

Tax deadline 2025

The tax deadline for 2025 is set for April 15. If this date falls on a weekend, it may shift to the next business day. Taxpayers should prepare their documents well in advance. This includes income statements and deductions.

Consider e-filing for quicker processing. If you need more time, file for an extension. Always stay informed about any changes in tax laws. Planning can ease the filing process significantly.

IRS: Need more time to file, request an extension

If you need more time to file your taxes, you can request an extension from the IRS. This gives you an extra six months to prepare your return. The process is simple and can be done online or by mail. Just fill out Form 4868 to submit your request.

An extension does not apply to tax payments. You still need to estimate and pay any taxes owed. It’s important to file on time to avoid penalties. Planning helps reduce stress during tax season.

Tax extension deadline 2025 California

In California, the tax extension deadline for 2025 is October 15. This date gives taxpayers extra time to file their returns. You can request an extension easily through the IRS or state forms.

People Also Read This Blog: belgium mehul choksi

This extension does not delay your tax payment. Be sure to estimate and pay any owed taxes by April 15. Late payments may incur penalties. Always keep records of your extension submission. Staying organized helps you meet your tax obligations.

Tax extension deadline 2024

The tax extension deadline for 2024 is October 15. This date allows taxpayers extra time to file their tax returns. To get the extension, you must submit Form 4868 by April 15. It’s important to note that any taxes owed are still due by the original deadline.

Failing to pay on time may result in penalties. You can file for the extension online or by mail. Keeping track of your extension is essential. Planning can make tax season much easier.

Americans impacted by 2024 natural disasters may qualify for extension to file taxes

In 2024, Americans affected by natural disasters may qualify for a tax extension. This is a relief measure from the IRS. It aims to help those facing urgent recovery needs. If you’re impacted, check the IRS website for updates.

You may have additional time to file your taxes. The extension applies to both federal and state returns. It’s essential to gather the necessary documents even if you have extra time.

Keep records of your expenses related to the disaster. This information will help when filing your return. Always stay informed about your options. Recovery is a priority, and tax deadlines can be flexible.

IRS extends April 15 tax deadline for Florida and at least 8 other states. See the list

The IRS has extended the April 15 tax deadline for Florida and eight other states. This extension is a relief for those affected by recent disasters. Taxpayers in these areas can file their returns later without penalties.

It’s vital to check if your state is on the list. Each state has specific guidelines for the extension. The official IRS website provides up-to-date information. Keep track of new deadlines to stay compliant.

This extension gives you more time to gather documents. Don’t forget to pay any taxes owed by the original deadline. Stay informed about any changes in tax laws. Recovery comes first, and the IRS aims to help.

IRS Approval In Only 5-Minutes | Secure & Easy Extension eFile

The IRS offers a quick way to get your tax extension approved. You can e-file for an extension in just five minutes. This process is secure and user-friendly. Simply fill out Form 4868 online to start.

No need to worry about complicated paperwork. The confirmation comes almost instantly. This allows you more time to gather your tax documents.

You still need to pay any taxes owed by the original deadline. Ensure your information is accurate to avoid delays. Using e-file is a smart choice for many taxpayers. Enjoy peace of mind knowing you have more time.

Final Words

IRS tax extension is a helpful option for many taxpayers. It provides extra time to file your tax return, reducing stress during tax season. It’s important to remember that it doesn’t extend the time to pay any owed taxes.

By filing Form 4868, you can enjoy up to six additional months for filing. This allows you to prepare accurately and avoid penalties. Always stay informed and manage your taxes wisely.

FAQ’s

Is there a penalty for filing a tax extension?

There is no penalty for filing a tax extension. You may face penalties if you don’t pay your taxes owed by the original deadline.

What happens if I don’t file by April 15th?

If you don’t file by April 15th, you may face penalties and interest on any taxes owed. It’s best to file for an extension or submit your return as soon as possible to minimize issues.

Is the extension beyond October 15?

The IRS extension typically ends on October 15th. After that date, you’ll need to file immediately to avoid penalties for late submission.

Are taxes due April 14, or 15?

Taxes are due on April 15th, unless it falls on a weekend or holiday. In that case, the deadline may be adjusted to the next business day.

Angleena is an SEO expert, content writer, and guest posting specialist with 3+ years of experience. She excels in SEO, link building, and digital marketing while ensuring unique, high-quality content for clients.