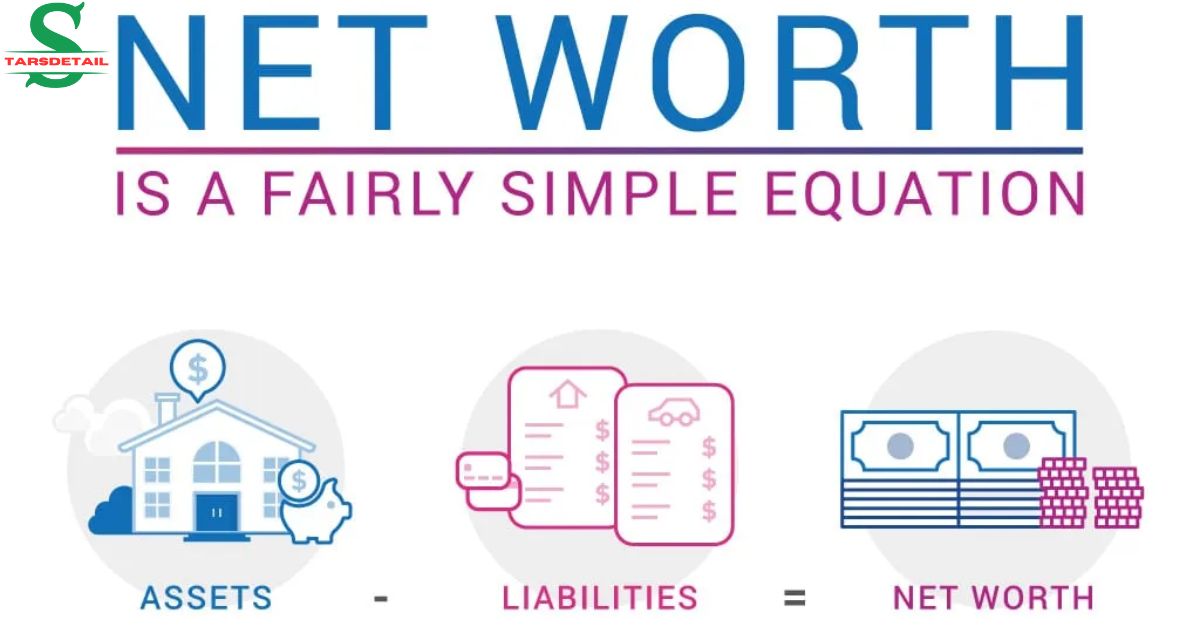

Net worth is the total value of what you own minus what you owe. It gives a clear picture of your financial health. To calculate it, you add up all your assets, like cash, property, and investments. Then, subtract your liabilities, such as debts and loans.

Calculating your net worth can be a real eye-opener! It helps you see where you stand financially and set future goals. Understanding this number can motivate you to save more or reduce debt. It’s a simple but powerful tool for financial planning.

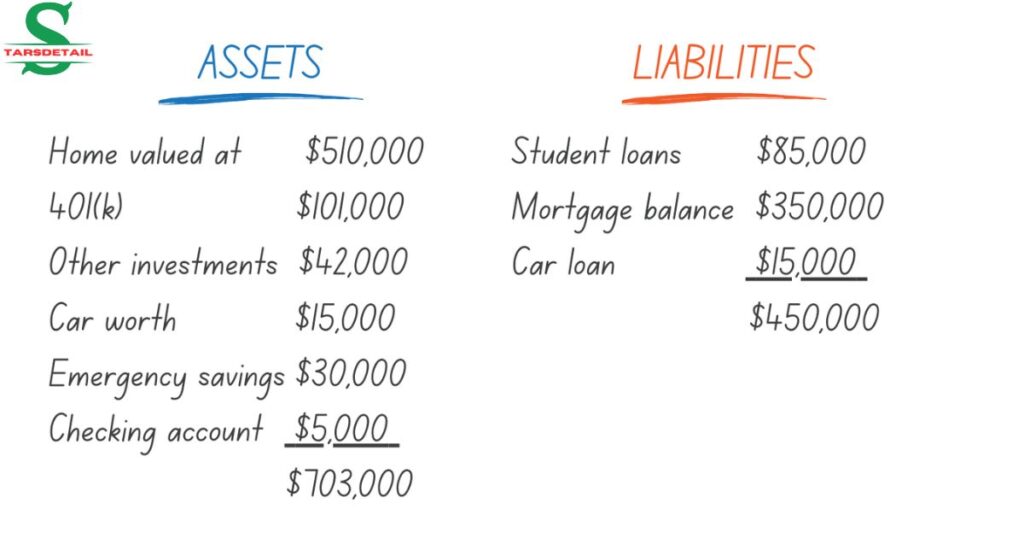

To find your net worth, list all your assets and their values. Common assets include savings accounts, real estate, and vehicles. Next, list your liabilities, like credit card debt and mortgages. Subtract the total liabilities from your total assets to determine your net worth. Regularly updating this calculation can track your financial progress over time.

What is net worth of a person

Net worth is a measure of wealth. It represents the difference between assets and liabilities. Assets include cash, property, and investments. Liabilities are debts and obligations. A positive net worth indicates financial stability.

A negative net worth means more debt than assets. People calculate net worth to assess their financial health using a net worth calculator. It can change over time with income and expenses.

Businesses also have net worth, reflecting their value. Monitoring how to calculate net worth helps in financial planning. It offers insights into spending and saving habits. Understanding what is my net worth is key to achieving financial goals.

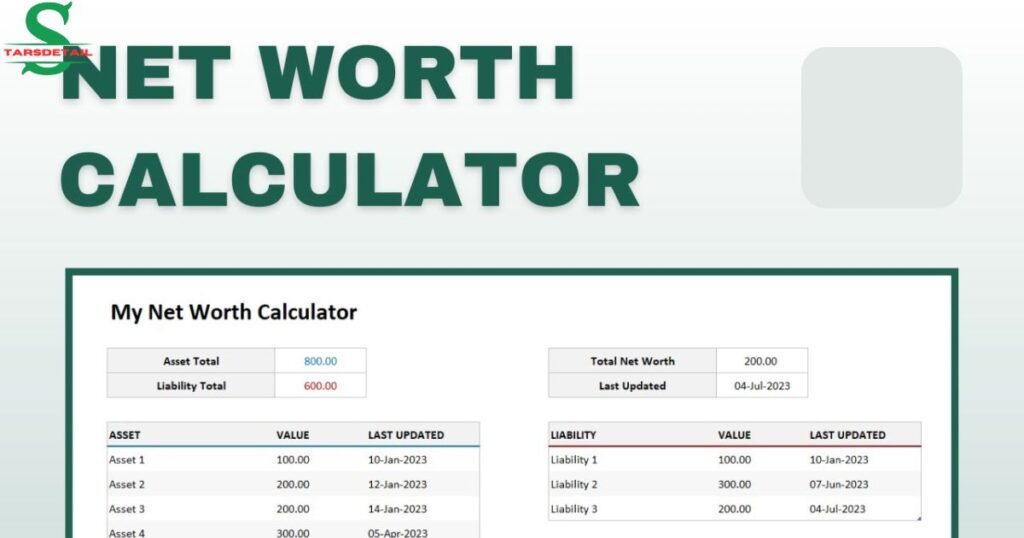

net worth calculator

A net worth calculator is a helpful tool. It simplifies the process of calculating wealth. Users input their assets and liabilities. The calculator then provides a net worth figure. This number shows financial health at a glance.

Many online calculators are available for free. They often include user-friendly interfaces to explain what is net worth. Some calculators allow for detailed breakdowns, including a high yield savings account. This helps users understand their finances better.

Don’t miss to read out this blog: Don King Net Worth

Tracking net worth over time is important. It shows progress toward financial goals. Regular updates can reveal spending habits. A net worth calculator promotes financial awareness. It’s a smart step toward better money management.

net worth

Net worth measures your financial health. It’s the difference between what you own and what you owe, and a net worth calculator can help you track this. Additionally, NerdWallet offers tools to simplify your financial assessments.

Regularly checking it helps track your progress. A positive net worth indicates good financial standing. It’s essential for planning future goals and understanding how to calculate net worth effectively.

- Calculate by subtracting liabilities from assets.

- Monitor changes over time for insights.

- Use it to guide your financial decisions.

how to calculate net worth

Calculating net worth is simple. First, list all your assets. Include cash, property, and investments. Next, list your liabilities. This includes debts like loans and credit cards.

Subtract the total liabilities from the total assets. The result is your net worth. A positive number indicates wealth, helping you understand what is my net worth in a clear way.

A negative number shows debt exceeds assets. It’s good to calculate regularly. This helps track financial progress over time. Understanding net worth is key to financial planning.

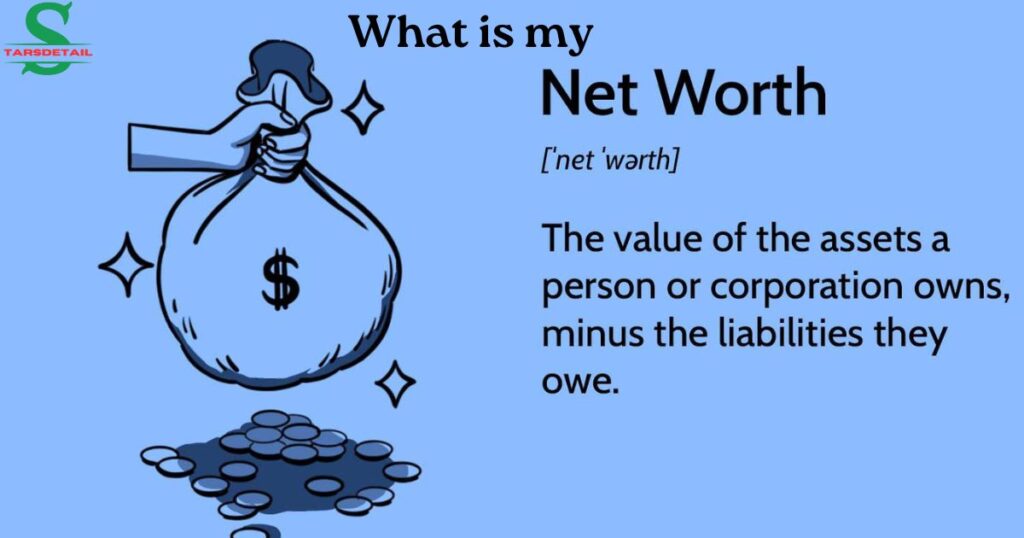

what is my net worth

Your net worth is a snapshot of your wealth. It shows the difference between what you own and what you owe. To find it, list your assets first. This includes cash, properties, and investments.

List your liabilities, like debts and loans. Subtract the total liabilities from your assets. The result is your net worth, which can be improved by utilizing a high yield savings account. Tools like NerdWallet can help you manage this effectively.

A negative net worth indicates more debt than assets. Knowing your net worth helps with financial planning. It reflects your financial health over time. Regularly checking it can guide your money decisions.

what is net worth

Net worth is a snapshot of your financial situation. It shows the value of your assets minus your liabilities, helping you understand what is net worth of a person and how it varies with net worth by age.

A positive net worth means you own more than you owe. It’s a key indicator of financial health, and understanding the net worth formula balance sheet is essential. Tracking it helps you set and achieve your liquid net worth goals.

- Assets include cash, property, and investments.

- Liabilities are debts like loans and credit cards.

- Regular updates can guide your financial planning.

Is net worth yearly

Net worth is not calculated yearly but can be. It represents your financial position at a specific time. Many people check it annually to track progress. Changes can occur due to income, expenses, and investments.

Major life events can also affect net worth, such as buying a house or paying off debt. For those interested in finance, knowing how to calculate net worth of a company is crucial. Regular assessments help in understanding trends, especially when considering is net worth yearly or more frequently.

People Also Read This Blog: https://www.celebritynetworth.com/

This keeps finances in focus. Tracking net worth often aids in financial planning and provides valuable net worth examples. It shows how well you are building wealth, and using a net worth calculator by age can enhance your understanding. Consistent monitoring leads to better money management.

high yield savings account

A high-yield savings account offers better interest rates. It helps your money grow faster than a regular account. These accounts are usually offered by online banks. They often have lower fees and minimum balance requirements.

Funds in these accounts remain easily accessible. You can withdraw or transfer money when needed. Interest rates can vary, so shop around. Some accounts offer promotional rates for new customers.

It’s a safe place to save compared to investments. High-yield savings accounts are FDIC-insured. This means your money is protected up to a certain limit. They are great for emergency funds and short-term savings.

nerdwallet

NerdWallet is a personal finance website. It helps users make informed money decisions, including using a net worth calculator to assess their net worth. You can compare credit cards, loans, and savings accounts as part of your financial strategy.

The site offers tools and calculators for budgeting, including options for a high yield savings account. It also provides expert articles and advice. NerdWallet aims to simplify financial choices for everyone.

- Users can find tailored recommendations.

- It features user-friendly comparisons.

- The site focuses on educating consumers about finance.

how much house can i afford

Knowing how much house you can afford is important. Start by analyzing your monthly income. Consider your current debts and expenses. A common rule is to spend no more than 28% of your income on housing.

Factor in additional costs like taxes and insurance. Get pre-approved for a mortgage to understand your budget, especially when considering what is net worth of a person. Use online calculators for quick estimates, including insights on net worth by age.

Think about your long-term financial goals, including understanding the net worth formula balance sheet. Choose a price that feels comfortable, not just the maximum. Your home should enhance your life, not stress you financially, and consider your liquid net worth in this decision.

retirement calculator

A retirement calculator helps you plan for the future. It estimates how much money you’ll need when you retire. You input your current savings and expected expenses.

The calculator shows if you’re on track, providing insights on how to calculate net worth of a company. It also suggests how much to save monthly. This tool is essential for achieving financial security and understanding is net worth yearly relevant to your goals.

- It considers factors like age and income.

- Users can adjust their retirement age and lifestyle.

- Regular use can refine your savings strategy.

compound interest calculator

A compound interest calculator helps you understand your savings. It shows how interest builds on interest over time. You input the principal amount, interest rate, and period. The calculator does the math for you.

You can see how your investment grows. It’s useful for planning long-term savings. Many calculators are available online for free. They can show different compounding frequencies too.

Understanding compound interest can boost your financial knowledge. It encourages saving and investing more wisely. Start using one to see your future potential grow.

high yield savings account

A high-yield savings account earns more interest than a standard one. It’s ideal for saving money over time. Online banks often offer these accounts. They tend to have lower fees and better rates.

Your money remains easily accessible. Withdrawals and transfers are straightforward, making it a great option for those looking at net worth examples. Interest is compounded daily or monthly, and these accounts are FDIC-insured for safety, which is why using a net worth calculator by age can be beneficial.

They help you save for emergencies or goals. Compare rates before choosing an account. A high-yield savings account can boost your savings effectively.

Conclusion

Calculating your net worth is a valuable step in financial awareness. It helps you understand your financial position clearly. By regularly assessing your assets and liabilities, you can track your progress over time.

This simple calculation can guide your budgeting and saving efforts. Knowing your net worth empowers you to make informed decisions for your future. Ultimately, it’s a crucial tool for building wealth and achieving your financial goals. Stay proactive and update your net worth regularly.

FAQ’s

What Is The Formula For Calculating Net Worth?

The formula for calculating net worth is simple, subtract your total liabilities from your total assets. This gives you a clear snapshot of your financial health.

What Is A Good Net Worth By Age?

A good net worth can depend on age and circumstances. By age 30, having a net worth equal to your annual salary is a solid goal.

Is A 401k Part Of Your Net Worth?

Yes, a 401(k) is part of your net worth. It counts as an asset since it contributes to your overall financial value.

Are Guns Included In Net Worth?

Yes, guns can be included in your net worth as assets. Their value should be assessed and added to your total assets when calculating net worth.

What Net Worth Is Considered Wealthy?

Net worth considered wealthy starts around $1 million. Perceptions of wealth can vary based on location and lifestyle.

Angleena is an SEO expert, content writer, and guest posting specialist with 3+ years of experience. She excels in SEO, link building, and digital marketing while ensuring unique, high-quality content for clients.