A trust is a legal arrangement where assets are held for the benefit of others. It helps manage wealth and can protect assets from taxes. Establishing a trust can ensure your wishes are followed after you’re gone. It’s a smart choice for many individuals.

You might wonder, At what net worth do I need a trust? The answer isn’t just about numbers. A trust can benefit anyone with assets to protect. Knowing when to set up a trust is crucial for effective estate planning.

Individuals consider a trust when their net worth reaches $100,000 or more. It’s not solely about the amount, it’s also about your goals. If you have specific wishes for your assets, a trust can help fulfill them. Consulting with a financial advisor can provide personalized guidance.

At what net worth do I need a trust?

Determining when to establish a trust isn’t just about net worth. While many suggest a threshold of $100,000, personal needs matter more. If you own significant assets, a trust can protect them.

It helps manage your estate and fulfills specific wishes. Consider your family dynamics and future goals. If you want to minimize taxes or avoid probate, a trust is beneficial.

Even lower net worth individuals may find value in one. It’s essential to assess your unique situation. Consulting a financial advisor can provide clarity.

How much money do you need to start a trust?

Starting a trust doesn’t require a set amount. Many suggest having at least $100,000 in assets. The purpose of the trust is more important. A trust can protect your wishes and streamline estate management.

Some people establish trusts with far less. Even small assets can benefit from this structure. It can help with tax efficiency and avoiding probate. Your family’s needs should guide your decision.

Don’t miss to read out this blog: what is liquid net worth

Consulting with a legal expert can clarify your options. Any amount can be significant depending on your goals. Trusts offer advantages at various financial levels.

at what net worth should you consider a trust?

You should consider a trust if your net worth is around $100,000 or more. It’s not just about the number. Think about your assets and family situation. A trust helps manage your estate and protect your wishes.

It can also minimize taxes and avoid probate. Even lower net worth can justify a trust for specific goals. Assess your unique circumstances carefully. Consulting a professional can help you decide.

There is no minimum

There is no minimum amount required to set up a trust. You can start with any sum that fits your situation. This flexibility allows more people to benefit from trusts. Even small contributions can make a significant impact.

- Trusts can begin with as little as $1,000.

- Every contribution adds value over time.

- You can adjust amounts as your needs change.

What can go in a trust?

The answer will always depend on your own personal situation. Almost everyone should have a will, but if your net worth is greater than $100,000, you have minor children, and you want to spare your heirs the hassle of probate and/or keep estate details private, consider adding a trust a mix.

How much money should you have for a trust?

You don’t need a specific amount to create a trust. Many experts recommend having at least $100,000 in assets. Your personal goals matter most. A trust can protect your wishes and manage your estate.

Even smaller amounts can be beneficial. It helps with tax planning and avoiding probate. Assess your family’s needs when deciding. Consulting a financial advisor can provide valuable insights.

how much do you need to start a trust fund

You don’t need a large sum to start a trust fund. Many suggest beginning with at least $10,000. However, smaller amounts can also work. The purpose of the trust is crucial. It can help with education, inheritance, or specific goals.

Even modest contributions can grow over time. Think about your long-term plans. Consulting a financial advisor can guide your choices effectively.

Ensure that it’s worth the cost

The answer will always depend on your own personal situation. Almost everyone should have a will, but if your net worth is greater than $100,000, you have minor children, and you want to spare your heirs the hassle of probate and/or keep estate details private, consider adding a trust a mix.

What else do you need to set up a trust?

To set up a trust, you need a clear plan. First, decide on the type of trust you want. Identify the assets you’ll include. You also need to choose a trustee to manage the trust. It’s important to outline the beneficiaries as well.

People Also Read This Blog: trump oscars

Legal documents are required to formalize the trust. Consulting an attorney can ensure everything is correct. Review and update the trust regularly as circumstances change.

Who needs a trust?

A trust can benefit many people in different situations. Those with significant assets often use them for protection. Families with special needs dependents can ensure care. Business owners may want to manage their company’s future.

- Parents wanting to secure their children’s future.

- Individuals with complex family dynamics.

- Those looking to minimize estate taxes.

Benefits of trusts

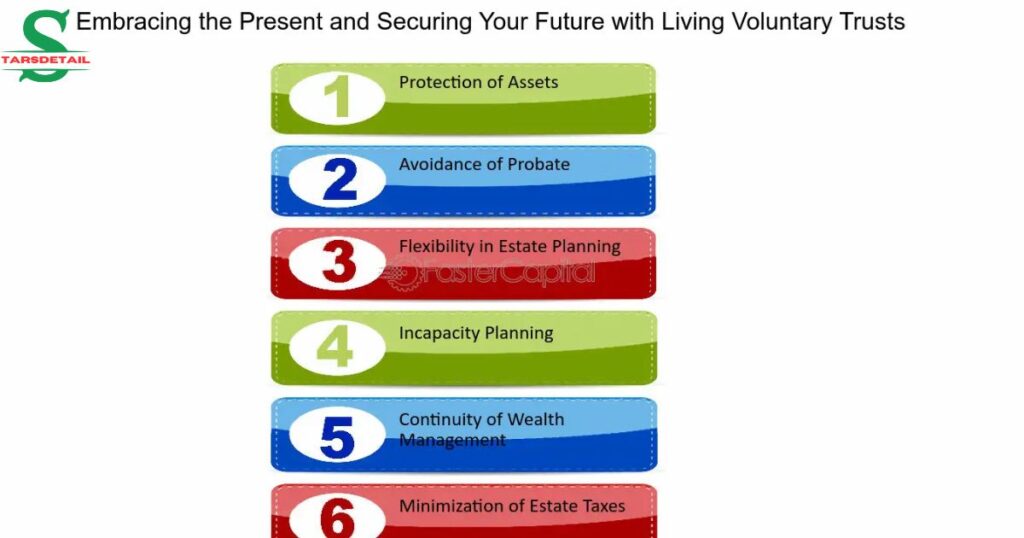

Trusts offer many benefits for managing assets. They help avoid probate, saving time and money. Trusts provide privacy, keeping your affairs confidential. They allow for the controlled distribution of assets.

You can set specific conditions for beneficiaries. Trusts can minimize estate taxes, preserving wealth. They protect assets from creditors and lawsuits. A trust can ensure care for minors or dependents.

It offers flexibility in managing investments. Trusts can adapt to changing circumstances. They provide peace of mind for families.

how much money do you need to set up a trust

You don’t need a large sum to set up a trust. Many experts recommend starting with at least $10,000. Smaller amounts can still be effective. The key is the purpose of the trust. Even a few thousand dollars can make a difference.

Trusts can grow over time with contributions. Consider your financial goals when deciding. The type of trust also matters for costs. Legal fees may vary based on complexity. Consulting a professional can guide your choice. Any amount can be significant for your needs.

Types of trusts

Trusts come in various types, each serving different purposes. Revocable trusts allow changes during your lifetime. Irrevocable trusts cannot be altered once established. Special needs trusts help support individuals with disabilities.

- Revocable Trusts: Flexible and can be modified.

- Irrevocable Trusts: Permanent and provide tax benefits.

- Special Needs Trusts: Ensure care for disabled loved ones.

at what net worth do i need a trust

You don’t need a high net worth to consider a trust. Many experts suggest starting around $100,000 in assets. The right amount can vary for everyone. A trust helps manage and protect your estate.

It can simplify the distribution of your assets. Even those with lower net worths can benefit. Special situations, like caring for dependents, matter too. Trusts can minimize taxes and avoid probate. Think about your goals and family needs. A financial advisor can help you decide.

how much money do you need to start a trust

You can start a trust with various amounts of money. Many experts recommend at least $10,000. You can establish smaller trusts too. The important factor is your goals.

Read This Blog: Don King Net Worth

Even a few thousand dollars can be effective. Trusts can grow over time with additional contributions. Legal fees may also influence your initial amount. Always consider your specific needs and plans.

at what net worth should you consider a trust?

The answer will always depend on your own personal situation. Almost everyone should have a will, but if your net worth is greater than $100,000, you have minor children, and you want to spare your heirs the hassle of probate and/or keep estate details private, consider adding a trust a mix.

how much do you need to start a trust fund

You don’t need a large amount to start a trust fund. Many experts suggest at least $10,000. However, smaller amounts can also work effectively. The focus should be on your goals and needs.

- Start with as little as $5,000.

- Legal fees may influence your budget.

- Define your purpose for the trust clearly.

how much money do you need to set up a trust

You don’t need a large sum to set up a trust. Many experts recommend starting with at least $10,000. Trusts can be established with smaller amounts, like $5,000. The key is to define your goals clearly.

Even a modest trust can help manage assets. It’s also important to consider ongoing contributions. Legal fees may add to your initial costs. Think about your financial situation and needs. Consulting a professional can help you decide the right amount.

Conclusion

The need for trust isn’t just about your net worth. While $100,000 is a common benchmark, personal goals matter more. If you have specific wishes for your wealth, a trust can help fulfill them.

It offers protection and ensures your assets are distributed according to your desires. Consulting a financial advisor can clarify your unique situation. Take proactive steps to secure your legacy, regardless of the numbers involved.

FAQ’s

What should your net worth be to have a trust?

You typically consider a trust when your net worth is around $100,000 or more. Personal goals and asset types are more important than just the number.

At what point is a trust worth it?

A trust is worth it when you have specific wishes for your assets or want to protect them from taxes. It offers peace of mind, regardless of your net worth.

How much money should I have before I set up a trust?

You should consider setting up a trust if you have at least $100,000 in assets. Your personal goals and circumstances are the key factors.

What is the 5 or 5000 rule in trust?

The 5 or 5000 rule in trusts allows beneficiaries to withdraw up to $5,000 from a trust each year without penalties. This provides flexibility while maintaining the trust’s overall structure.

What is the average amount of money in a trust?

The average amount in a trust varies widely but often ranges from 200,000to200,000 to 200,000to1 million. It depends on individual circumstances and estate planning goals.

Angleena is an SEO expert, content writer, and guest posting specialist with 3+ years of experience. She excels in SEO, link building, and digital marketing while ensuring unique, high-quality content for clients.